Make Your Voice Heard

AFP’s mission is to empower every American to achieve their unique version of the American Dream.

Get Involved Now

Whatever your American Dream, we all need freedom and opportunity to realize it. That’s what Americans for Prosperity fights for. We partner with concerned citizens like you to create change in your community and together help improve the lives of millions of Americans.

TAKE ACTIONMake your voice heard today. Receive email alerts to learn how to get involved in your community.

Join our newsletter

Receive email alerts to learn how to get involved

Join the Fight Today (Stay in Touch) (Sidebars)

Newsroom

Read More

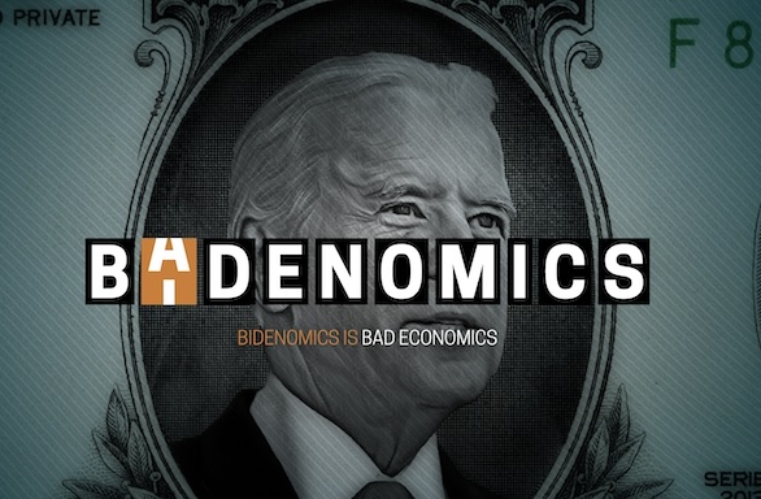

Campaign Features Bidenomics.com – The Website Joe Biden Doesn’t Want You to See Arlington, VA – Americans for Prosperity has launched a sustained new eight-figure campaign focused on Bidenomics just in… read more

For years, many West Virginia parents have been frustrated. One-size-fits-all… read more

For years, many West Virginia parents have been frustrated. One-size-fits-all… read more

For nearly two decades, people have chosen to partner with… read more

For nearly two decades, people have chosen to partner with… read more

Success Stories

Watch MoreWatch as Americans for Prosperity-Nevada’s grassroots engagement director, Wiz Rouzard,… read more

In November 2020, Arizona voters narrowly approved a ballot initiative,… read more

Waterloo, Iowa resident William Burt had dreams of operating his own… read more

Hold Your Politicians Accountable

Americans for Prosperity's national scorecard lets you know which lawmakers are the principled policy champions our country needs.

View ScorecardKEY VOTES

Key Vote Alerts

Not able to keep up with what’s moving through the legislature? AFP can help you keep informed.

SIGN UP

Join the movement to empower every American. You have the power to change the trajectory of our country. See how you can with Americans for Prosperity.

© 2024 AMERICANS FOR PROSPERITY. ALL RIGHTS RESERVED. | PRIVACY POLICY

Join the Fight Today

Receive action alerts to learn how to get involved in your community

Join our newsletter

Receive email alerts to learn how to get involved