Is Social Security in Trouble? Yes, and We Need Automatic Fiscal Stabilizers to Help

Social Security is in trouble

The Social Security Trustees’ latest report on June 2 has bad news: Social Security’s Old Age and Survivors Insurance (OASI) trust fund is rapidly running out of money.

The trustees say the OASI trust fund will be exhausted in 2034. At that point, all beneficiaries will get a 23% cut to monthly benefits unless Congress acts. CBO’s Budget and Economic Outlook: 2022 to 2032 had similar estimates in May 2022.

When will Congress act to address how to make Social Security solvent?

Bipartisan, bicameral support for specific strategies to extend Social Security solvency already exists.

- The Time to Rescue United States Trusts (TRUST) Act by Sens. Mitt Romney (R-Utah), Angus King (I-Maine), and Joe Manchin (D-West Virginia) and by Reps. Mike Gallagher (R-Wisconsin), Ed Case (D-Hawaii), and Scott Peters (D-California) would set up a commission for each major, endangered trust fund program including Social Security and Medicare.

- The Sustainable Budget Act by Reps. Ed Case (D-Hawaii) and Steve Womack (R-Arkansas) and Sen. Cynthia Lummis (R-Wyoming) would set up a fiscal commission to pursue budget balance other than interest on the debt within a decade. This would likely require addressing imbalances in Social Security and Medicare.

- AFP’s unified budget concept proposes including all spending and all revenue in a single budget bill. This would help members of Congress extend solvency and otherwise improve important programs in the context of the entire budget and with associated tradeoffs in mind.

The Government Accountability Office recently called on Congress to address financing gaps for Medicare and Social Security. Yet Congress continues to delay reform and shows little sign of breaking the stalemate.

Social Security needs automatic fiscal stabilizers

Congress too often waits for a challenge to become a crisis before it acts. This procrastination harms both Social Security beneficiaries and the taxpayers who fund today’s benefits.

Automatic fiscal stabilizers would replace inaction with specific changes in statute to improve solvency and, if done well, prevent the trust funds from becoming depleted after multiple rounds of adjustments. They could also motivate Congress to act with better alternatives, but automatic enforcement must be reasonable to minimize Congress’ temptation just turn them off.

Automatic triggers can keep Social Security solvent

- How: Identify provisions in current law — and/or create new dials — that can be adjusted repeatedly.

- Choose a benchmark: For example, reduce 1/10 of the OASI funding gap in the 20th

- OMB executes: The Office of Management and Budget (OMB) works through the list, possibly more than once, to meet the funding gap reduction target. Each round would begin with the option following the last one used.

Illustrating automatic fiscal stabilizers for Social Security

- Measure: Each year, based on the Social Security Administration’s projected deficit for OASI in, say, the intermediate scenario in 20 years (2042).

- If no shortfall is expected, no automatic action occurs.

- If a gap is anticipated, the savings target could be, say, one-tenth of that amount.

- Illustrative options: To reduce benefit growth for future retirees:

- Increase normal retirement age by a few months per birth year

- Increase early retirement age by a few months per birth year

- Use chained CPI to adjust COLAs for a few years

- Reduce the 15% or 38% “bend points” for income replacement rates for the initial Primary Insurance Amount (PIA) while leaving the 90 percent replacement rate alone

- Index some PIA bend point brackets by prices instead of wages

- Add months or years to work history to those counted in the PIA (currently 35 years

- Add a quarter to eligibility to be a fully insured individual (currently 10 years)

Can automatic fiscal stabilizers really prevent Social Security insolvency?

Automatic adjustments can be scaled to prevent trust fund depletion entirely or only to delay exhaustion while Congress considers better approaches than repeated, incremental changes can provide.

Under the 2042 Intermediate scenario (sheet IV_B, cells E38-E39), the OASI shortfall is projected to be about 3.50% of payroll. Automatic fiscal stabilizer policies in 2022 to reduce that shortfall by 10 percent would require reducing the shortfall by 0.35% of payroll in 2042, at least in this proposal.

Reducing the shortfall by the same amount over the entire 2022-2042 period would require larger changes, while doing so over the 75-year projection period (2023-2097) would require less change but probably not avoid trust fund depletion.

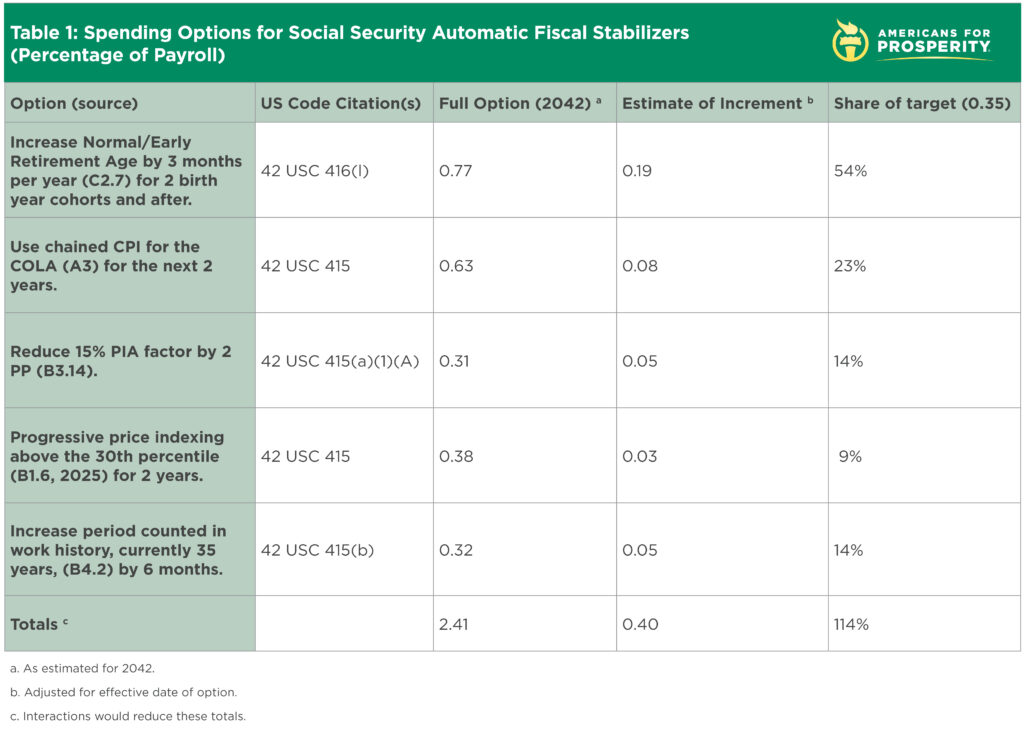

Table 1 shows how this can work.

Each line adapts existing estimates with a goal to reduce the shortfall by 0.35% of payroll in 2042. Understanding interactions and other technical issues would require close collaboration with the Social Security Actuary. Note also that the official estimates include Disability Insurance, while this article focuses on OASI alone.

Table 1: Spending options for Social Security automatic fiscal stabilizers (percentage of payroll)

These five incremental, repeatable options would exceed the overall target by 14%.

Slightly increasing any of the first four options would mean that the fifth item would go unused during the first round, and the next round would begin with it before starting at the beginning of the list again. An option could be triggered more than once in a year to meet the savings target. This approach can clearly work.

Should revenue be included when considering automatic fiscal stabilizers as a solution for Social Security’s solvency gap?

Closing Social Security’s solvency gap in full by reducing spending growth is ideal. Reducing spending growth is better for economic growth than increasing revenue.

Even so, raising revenue may be necessary to obtain and sustain congressional agreement on automatic fiscal stabilizers.

If adopted too close to a solvency crisis, the math may require even more aggressive spending and revenue changes to stave off trust fund exhaustion. Waiting until Social Security reaches a solvency crisis, however, means greater uncertainty, and it risks much worse outcomes than a palatable but less-than-ideal package.

How automatic fiscal stabilizers could include revenue:

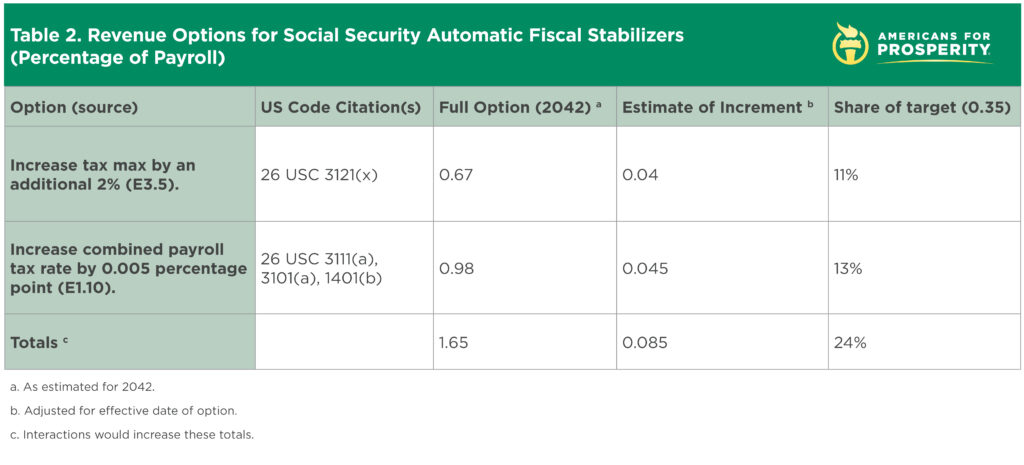

- Subdivide the savings target: Use a pre-set ratio to allocate savings between spending and revenue. With a 4:1 ratio, OMB would order the congressionally specified changes necessary to close 80% of the solvency gap from spending savings and 20% from revenue. With the same savings target of 0.35% of payroll, savings of at least .28% of payroll (4/5 of 0.35) would come from spending and at least 0.07% of payroll (1/5 of 0.35) from revenue.

- Revenue options: A second list of revenue changes (see Table 2) would supplement the incremental spending changes. Illustrative revenue options:

- Increase the FICA “tax max” ($147,000 in 2022) slightly faster than the standard average wage adjustment.

- Increase the FICA payroll tax rate.

Table 2: Revenue options for Social Security automatic fiscal stabilizers (percentage of payroll)

Illustrative automatic adjustments from both spending and revenue changes:

- Spending: The first three spending changes in Table 1 would provide about 91% of the overall target (80% required). Subsequent automatic savings would pick up where the last one left off.

- Revenue: These two revenue changes in Table 2 would provide about 24% of the overall target (20% required). Doubling the size of change to both parameters would mean, at least initially, that only one would be needed to hit the target in any year, so they would alternate. More granular adjustments to each, however, would keep the total savings from revenue closer to the target as approaching solvency reduces the size of the targets.

Repeating this process should delay OASI trust fund exhaustion date indefinitely while gradually closing the financing gap. If these seven options were enacted in full, they would collectively exceed the 3.50% of payroll financing gap by a substantial margin.

The dynamic approach of automatic fiscal stabilizers, however, adjusts the required savings to match the financing gap. As savings narrow the next year’s shortfall in twenty years, fewer subsequent adjustments would be needed to keep the Social Security Old Age and Survivors Insurance program solvent.

Solvency is an important goal for Social Security but hardly the only one.

Setting the program on the course of fiscal stability through reasonable, incremental changes to existing parameters in statute, however, could empower Congress to find other ways to improve value for both taxpayers and beneficiaries.

It would also encourage Congress to find even better ways to secure solvency, as retired Senator Rudy Boschwitz from Minnesota recently described in the Wall Street Journal.

Changing Social Security’s default trajectory from insolvency to sustainability would improve the federal government’s fiscal outlook, America’s economic performance, and Congress’ stewardship of Social Security.

It would also help prevent a trust fund crisis and perhaps a broader fiscal crisis. Automatic fiscal stabilizers could provide more certainty for Social Security beneficiaries, taxpayers, and the legislators charged with overseeing the program.

Contact Kurt today to learn more about automatic fiscal stabilizers and other Social Security solutions.