Please select your state

so that we can show you the most relevant content.

Most federal budget information is either too condensed to illustrate relative priorities or too detailed to sort through. Little information exists in an accessible, broadly surveyable format. It’s like trying to navigate but only with raw satellite photos and Google’s Street View™.

Congress could, however, borrow a best practice from the states: line-item budgets.

A line-item budget lists each program, the last-enacted amount, and the proposed amount(s) with a single line per spending account. It condenses the entire budget into relatively few, digestible pages.

Those involved in the details of budgeting need dense information, but no legislator needs, wants, or can use all of it. Most specialize based on their committee assignments or life experiences. On other subjects, they often rely on the expertise of trusted colleagues and advocates.

Engaged legislators do, however, need broad legal and budget context.

The president’s budget request includes top-line totals. It also provides the details that specialists need in the voluminous appendix, along with analytical perspectives, historical tables, and supplemental materials. It does not, however, provide much of that middle ground.

By contrast, governors in many states provide legislatures with a line-item budget in addition to spending and revenue aggregates and programmatic details.

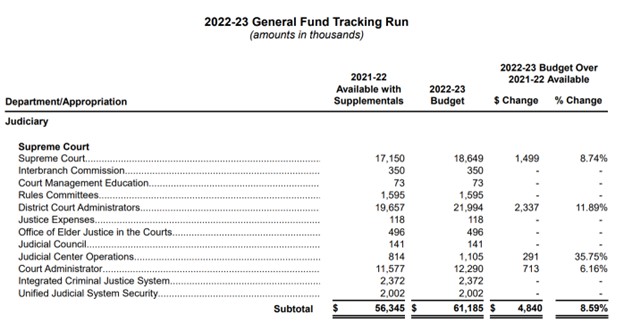

In Pennsylvania, for example, the governor’s proposed budget line-item appropriation (see excerpt in Figure 1) supplements other budget documents including the full budget proposal.

Rather than hundreds of pages for all 17 appropriations acts (not counting Pennsylvania’s shadow budget) or various overview visuals, the latest proposed line-item budget was only 11 pages long. Legislators can absorb and refer to that level of detail relatively easily while still seeing the overall picture.

Figure 1: Excerpt of line-item appropriations from Pennsylvania governor’s budget proposal

Source: Pennsylvania Governor’s Office

At the federal level, a related resource already exists.

In addition, the Joint Committee on Taxation publishes a list of tax expenditures, sometimes deemed “spending through the tax code.” Granted, proponents of a consumption tax baseline take issue with JCT’s designation of business cost recovery provisions as tax expenditures.

These CBO and JCT products, however, display current-law projections and exclude many features of the tax code. A line-item budget could consolidate spending and revenue items, including proposed changes. It might also focus on the budget year to be addressed by the pending budget and appropriations legislation instead of the entire 10-year forecast.

Figure 2 illustrates a small portion of a possible approach to a line-item budget for the federal government. It resembles the tables at the end of reports accompanying appropriations bills, but it could include all spending accounts—appropriated and direct—as well as revenue line items.

Figure 2: Excerpt from a federal line-item budget

| Department/Appropriation

(Budget authority, $thousands) |

FY2021 Enacted | FY2022 Enacted | FY2023 President | FY2023 House | FY2023 Senate |

| NASA (subfunction 252) | 21,489 | 24,041,300 | 25,973,800 | 25,446,200 | 25,973,800 |

| Science ……………………………………………………. | 7,297,000 | 7,614,400 | 7,988,300 | 7,905,000 | 8,045,700 |

| Aeronautics ……………………………………………… | 845,000 | 880,700 | 971,500 | 950,000 | 971,500 |

| Space Technology ……………………………………… | 1,100,000 | 1,100,000 | 1,437,900 | 1,250,000 | 1,263,850 |

| Deep Space Exploration Systems …………………. | 6,512,000 | 6,791,700 | 7,478,283 | 7,323,700 | 7,547,750 |

| Space Operations ……………………………………… | 3,988,000 | 4,041,300 | 4,266,317 | 4,256,000 | 4,293,500 |

| STEM Engagement ……………………………………. | 127,000 | 137,000 | 150,100 | 150,100 | 150,100 |

| Safety, Security and Mission Services …………… | 2,937,000 | 3,020,600 | 3,208,700 | 3,138,700 | 3,228,700 |

| Construction/Enviro Compliance/Restoration .. | 439,000 | 410,300 | 424,300 | 424,300 | 424,300 |

| Office of Inspector General ………………………… | 44,000 | 45,300 | 48,400 | 48,400 | 48,400 |

Sources: OMB, House Appropriations, Senate Appropriations

In any case, Congress has several options to establish federal line-item budgets:

Regardless of its form, a line-item budget could give Congress a much-needed, manageable overview of federal spending allocations and revenue collections. It would be especially valuable if Congress considered a comprehensive budget each year with all spending and revenue.

A line-item budget could provide an overview of resource allocation across the federal government. This middle-ground information would supplement broader aggregates as well as the details that specialists need to manage related programs. Federal line-item budgets may be especially welcome to the many former state legislators who now serve in Congress and miss having them during budget season.

© 2024 AMERICANS FOR PROSPERITY. ALL RIGHTS RESERVED. | PRIVACY POLICY

Receive email alerts to learn how to get involved