States and localities aren’t utilizing coronavirus bailout funds, despite demands for Congress to provide hundreds of billions of additional relief

Politicians and special interests are demanding that Congress provide hundred of billions of additional dollars to bail out state and local governments. However, two recent government reports show that state and local governments are not substantially utilizing the bailout funds already available to them.

More than 75 percent of Coronavirus Relief Fund dollars already in state and local government accounts are still unspent and more than $498 billion in lending authority from the Federal Reserve remains untapped.

Significant federal aid is already available

This year, the federal government has already made nearly $2 trillion in assistance available to state and local governments. More than $1.1 trillion of that available aid is directly related to COVID-19.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted in March, established two new programs meant to provide flexible budgetary assistance to state and local governments. Despite the availability of this flexible assistance and the demands for more bailouts, neither program has been substantially utilized by state and local governments.

Coronavirus Relief Fund

The Coronavirus Relief Fund provided $150 billion to state and local governments to be used for “necessary expenditures incurred due to the public health emergency with respect to COVID-19,” through December 30, 2020, that were “not accounted for in the budget most recently approved.” This is an open-ended invitation for states to spend on new programs, projects, and activities on the backs of federal taxpayers.

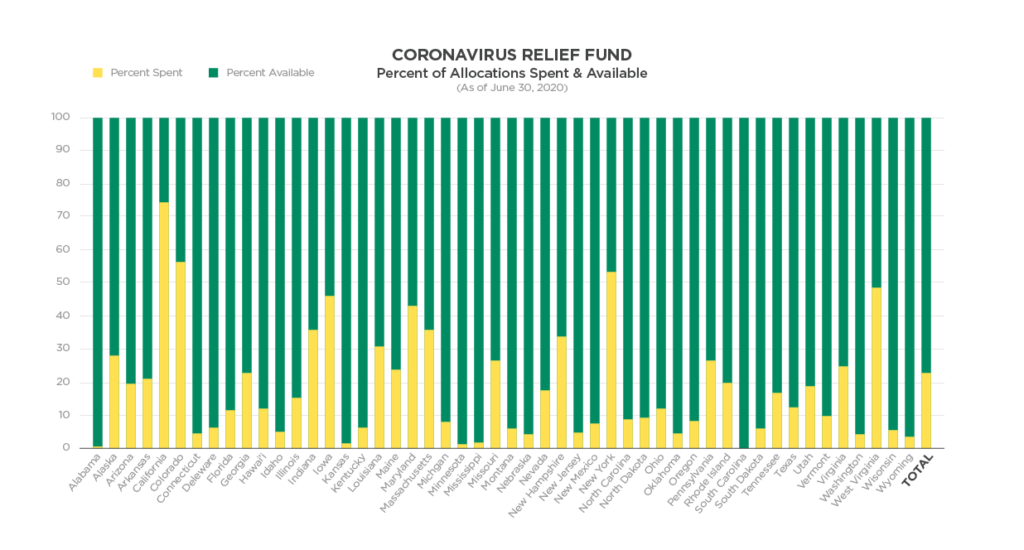

According to a new oversight report from the Department of the Treasury Office of Inspector General, state and local governments have spent only $34 billion, or 22.8 percent of the $150 billion Coronavirus Relief Fund over the period covering March through June.

Many states have spent very little of their allocation. South Carolina has spent less than .1 percent of its available funding. Twenty-three states have spent less than 10 percent of their allocations and 37 have spent less than a quarter. California leads the way by spending more than $11 billion of its $15 billion bailout.

All told, state and local governments have more than $115 billion of taxpayer bailout funds sitting unused in their bank accounts. It would be irresponsible for Congress to rush to provide hundreds of billions more for state and local leaders that have so far proven unable to effectively and efficiently allocate what has been provided.

What’s more, we don’t yet even know how the $34 billion was spent. States are required to track and report this information, but it is not yet publicly available. Are funds being spent on important public health expenses, like testing and personal protective gear, or are they being spent on wasteful pet projects?

Municipal Liquidity Facility

The Federal Reserve established the Municipal Liquidity Facility to purchase up to $500 billion in debt issued by state and local governments, backed by $35 from the Treasury under the CARES Act. This is the first time the Federal Reserve has engaged in the direct purchase of municipal bonds.

The Federal Reserve has processed exactly one transaction under the Municipal Liquidity Facility, according to the most recent Federal Reserve Report to Congress.

The Fed purchased $1.2 billion of BBB- rated debt issued by the state of Illinois at a 3.82 percent interest rate, a move which came after the state “put off a planned auction of such short-term debt as the interest rates demanded by investors soared amid concern it could be the first state to have its bonds cut to junk.” This purchase represents only .24 percent of the total liquidity available from the Municipal Liquidity Facility for state and local governments.

This facility can provide an emergency backstop to fill budgetary gaps. If state and local governments are unwilling to budget responsibly, and even if the bond markets are unwilling to lend, the Fed has provided a guaranteed line of credit. The fact that only one state has used the facility shows that additional bailouts are not needed.

Calls for more bailouts should be rejected

The national debt has surpassed $26.5 trillion, growing by more than $3 trillion since the CARES Act was signed into law. Even before the outbreak of COVID-19, the federal budget was on an unsustainable path.

Bailouts are an example of the federal government overstepping its authority. States should govern wisely and independently, both reaping the rewards of smart policy and addressing the consequences of bad fiscal management.

The federal government has already provided an unprecedented level of assistance to state and local governments which is not currently being fully utilized. Lawmakers should reject bailouts of state and local governments.

Rather than continuing to spend indiscriminately, Congress should focus on real priorities: suppressing the virus, getting people back to work, and preparing for the next crisis so we can emerge from this pandemic stronger than before.