Block grants can reconcile state aid with health, prosperity, and federalism

Federal sprawl stretches Congress too thin to manage its core responsibilities well. Bloated bureaucracy and overreaching laws have stripped state and territorial governments (hereafter, “states”) of effective control in many areas where they should predominate, if not have exclusive authority. Excessive federal spending and debt drive up interest and inflation rates, and they threaten a damaging debt crisis.

Fortunately, this Congress can use the special procedure known as budget reconciliation to drain the swamp, restore state sovereignty, generate savings to support pro-growth tax reforms, and give states the freedom to meet their residents’ needs without the heavy hand of distant and distracted federal overseers.

Other countries with empowered sub-national governments use broad block grants with few strings or even general revenue sharing with more autonomy. America could benefit from the block grant concept as well. A block grant means that the national or federal government transfers funds to state or provincial governments and lets them have broad discretion. By capping and consolidating funding while maximizing local flexibility, a block grant makes for a win-win for beneficiaries and taxpayers alike.

Declutter DC with state-empowering block grants

Budget reconciliation gives Congress a real – if limited – ability to coordinate and simplify programs. Congress can also use the procedure to create new programs with appropriate terms and conditions while repealing others.

As it moves forward with reconciliation legislation, Congress should consider, along with its other options, creating a new State Empowerment Block Grant and a separate Make America Healthy Again Block Grant to replace various federally-funded, typically state-administered, direct spending (“mandatory”) programs. Annually appropriated (“discretionary) state-aid programs could be integrated later, and these block grants could become discretionary spending, but neither of those steps may be possible through budget reconciliation.

These block grants would not include refundable tax credits or other programs administered through the tax code other than the premium tax credits from the Patient Protection and Affordable Care Act (“Obamacare”). They also generally would not cover programs administered directly to individuals like Medicare or Social Security, nor would they include federal funds to tribal governments.

State agencies already run many health, education, training, income support, and other activities. Programmatic inertia and state laws would ground program delivery under block grants in current practices. That said, state legislators and governors would have more flexibility to eliminate welfare cliffs, to focus funds on the most vulnerable and where they would do the most good, and to try new ideas that may be more effective and valuable.

These block grants could yield budget savings for all taxpayers, not just through the federal government. Formula-based allocations would require less administration. State and local governments would have less paperwork and reporting. And freedom from federal strings would let non-federal legislators and officials drive dynamic efficiencies.

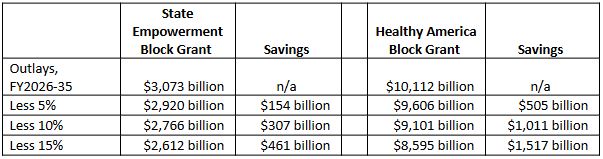

Savings compared to current policies would depend on the initial spending level and subsequent growth compared to what it would replace. Savings are dialable. Table 1 estimates the effects of total savings for block grants that replace programs listed in the Appendix, assuming a few illustrative levels of overall spending reduction. To make analysis easier for lawmakers, the Appendix is sorted by the committee of jurisdiction in the U.S. House of Representatives.

Table 1: Potential savings from state empowering block grants

Source: CBO, authors’ calculations

In addition to overall spending levels, allocations between states would be crucial decisions. Congress’s many options would reflect politics as much as policy. Factors could include population, share of population below the poverty level, adjusted for population ages or cost of living, density, or mean or median household or per capita income, among others. Each recipient jurisdiction could be guaranteed a minimum with additional funds disbursed based on other factors. Ideally, these grants would approximate general revenue sharing, where states have maximum flexibility and the federal government has minimum control with improved fiscal certainty.

Finally, applicable rules indicate that revenue sharing or broad block grants would be direct spending programs overseen by the Senate Finance Committee and the House Ways and Means Committee. The Senate Finance Committee and the House Committee on Energy Commerce could manage a Healthy America Block Grant. Crucially, those jurisdictional alignments would allow Congress to enact these reforms assuming the anticipated 2025 reconciliation instructions under the House budget resolution.

State empowering block grants can help Congress focus on national issues while supporting pro-growth tax reform, can empower states to serve their residents better, and can promote flexible, creative solutions to the challenges facing all Americans.

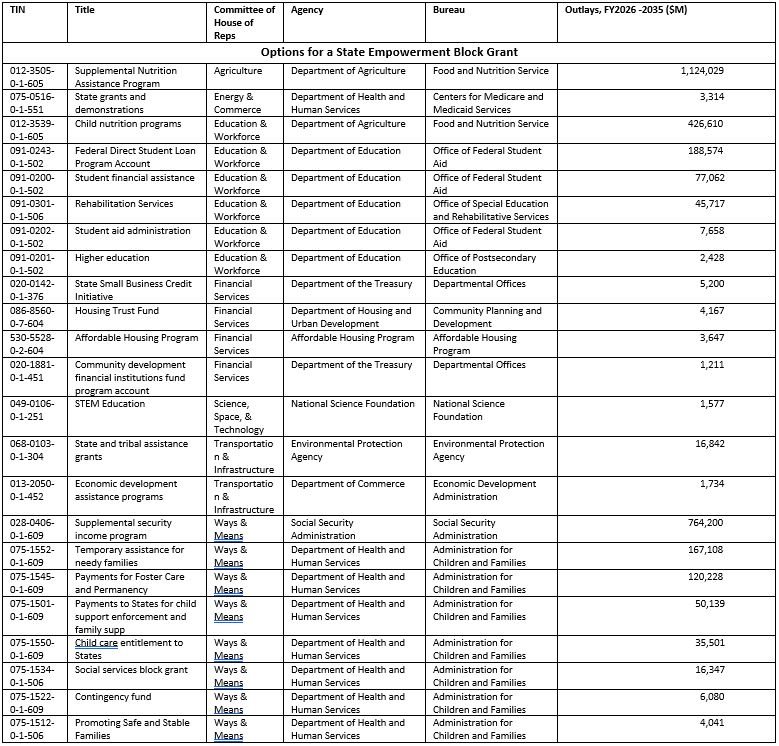

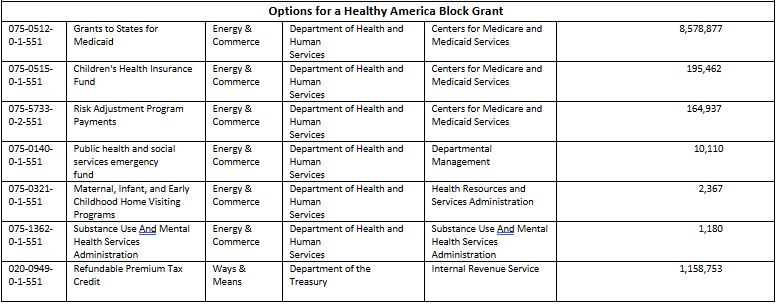

Appendix: Illustrative programs for block grants through budget reconciliation

Note: Table lists spending accounts with $1 billion or more in budget authority and outlays over the next decade. Congress could include smaller programs as well.

Source: CBO