Pension Liabilities Outpacing State Economies Around the Country

Public pension funds are threatening the fiscal stability of many states and localities. Many people, including the leadership of government unions, blame underfunding and have been demanding state governments increase taxes and funnel even more money into the system. But a new study says underfunding is a symptom, not a cause.

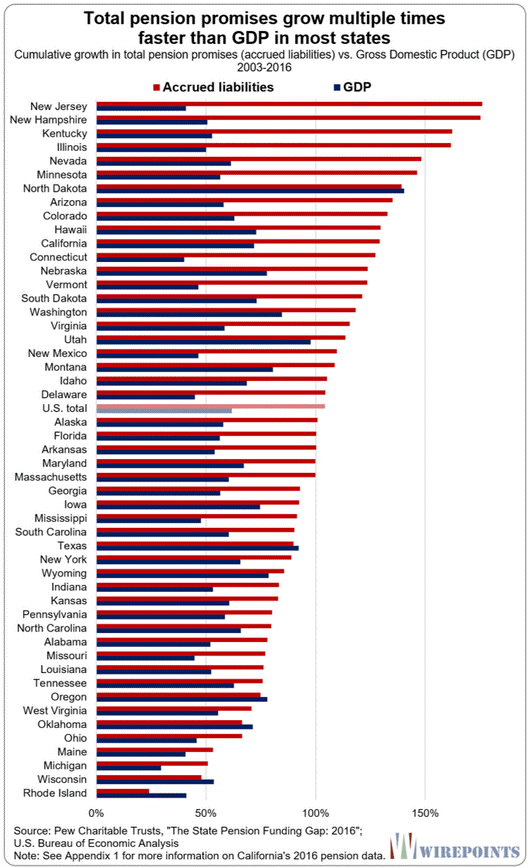

The report from Wirepoint looked at pension data from 2003 to 2016 and found that in all but six states, the government’s share of pension responsibilities grew faster than the state’s economy. That means that taxpayers’ burden is growing faster than their ability to pay for it.

In 28 states, accrued liabilities outgrew their economies by 50 percent or more between 2003 and 2016.

And 12 states were totally overwhelmed by increases in their accrued liabilities. The total growth was more than double that of their economies.

The real culprit? Overpromising. For decades, state and local governments have been making guarantees to public employees that are impossible to keep. Now their pension liabilities are overwhelming their economies and far outpacing taxpayers’ ability to keep up with the growth.

In New Jersey, pension liabilities grew more than four times faster than the state’s gross domestic product. In Illinois, it grew three times faster than the state GDP.

As bad as the pension crisis is for taxpayers, it’s just as bad for public employees like teachers and public safety officers, many of whom are trapped in what amounts to a pyramid scheme and won’t see the benefits they’re paying for when they retire.

Fortunately, the recent Supreme Court decision in Janus v. AFSCME empowers public employees to begin fixing this problem. Because government workers are no longer required to pay union dues or fees, they are no longer forced to fund the union negotiations that created irresponsible, unsustainable pension deals.

That’s exactly why Mark Janus, the Illinois Department of Public Health employee behind the Supreme Court case, brought the lawsuit. He didn’t support his union’s role in creating the pension crisis in his home state.

If states are going to begin getting their pension shortfalls under control with reforms like moving to defined contribution plans instead of antiquated and unaffordable defined benefits, now is the time to do so. And thanks to Janus, public employees can become part of the solution for taxpayers.

Join the fight today: Tell your lawmakers to support worker’s rights by voting for the Employee Rights Act!